VMR Market Regime - Market Breadth Chart & Analysis

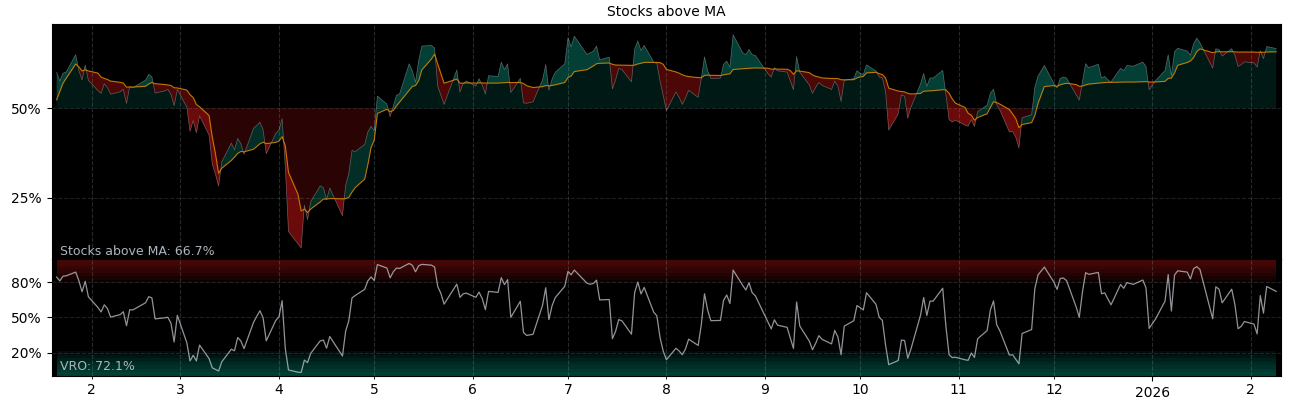

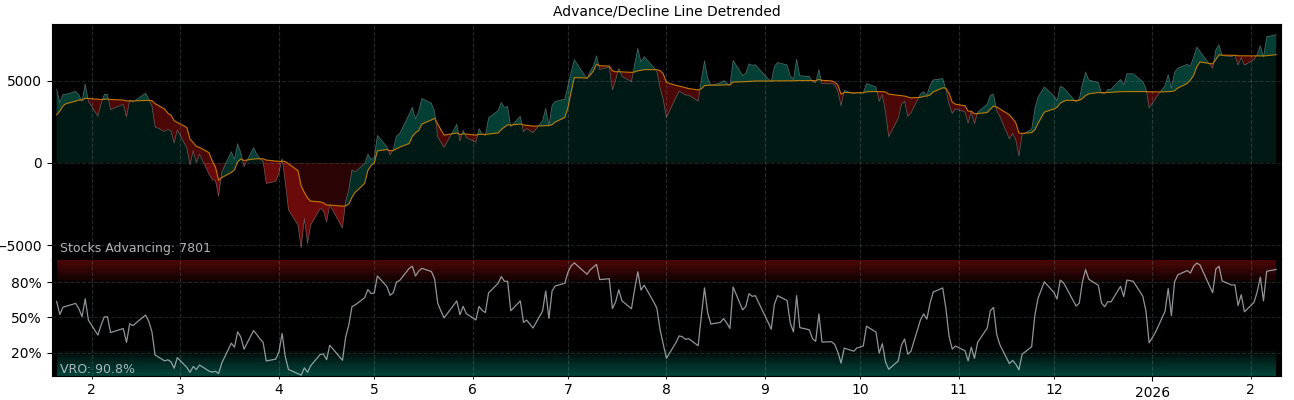

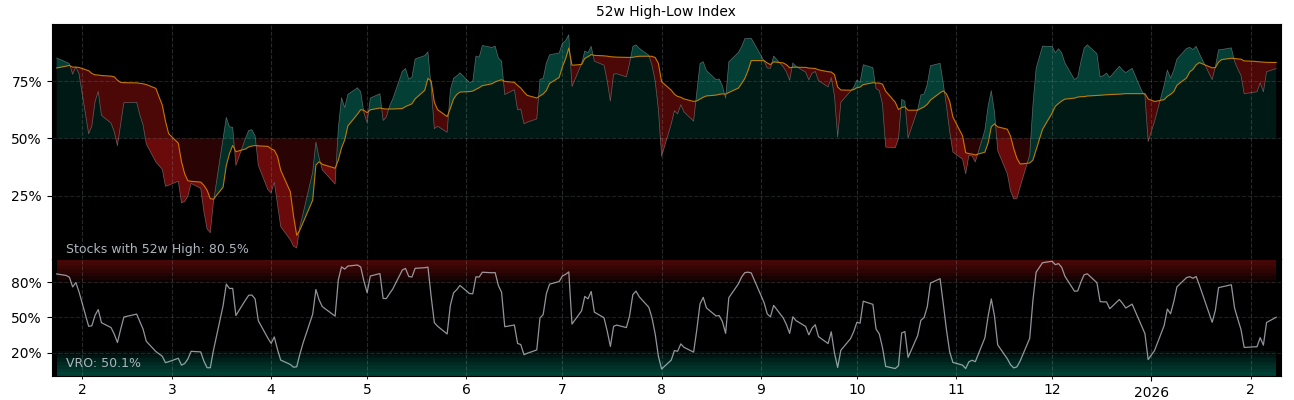

High Precision Market-Regime Indicator: Stocks above MA + 52 Week High/Low + Advance/Decline Line, combined with our ValueRay Oscillator VRO.

ValueRay Market Regime (VMR) - US Equity Market Breadth Indicator as of 09.Feb 2026

VMR: 70.59

VMR Trend 4 days: +7.76

VMR Trend 8 days: +2.13

VMR Trend 4 days: +7.76

VMR Trend 8 days: +2.13

Regime:

Bullish

Trend Analysis: Building Uptrend Momentum

Buy Signal: 0.5

Trend Analysis: Building Uptrend Momentum

Buy Signal: 0.5

Market Regime - S&P 500 Analysis (SPY ETF) as of 2026-02-07 13:18:57

- SPY Price: 690.62 USD

- SMA 20: $688.99

- SMA 50: $685.85

- SMA 200: $642.36

- 52 Weeks Low: $492.19

- 52 Weeks High: $695.49

- GARCH Volatility: 15.08

- ATR: 7.40 (1.09%)

- Relative Volume: 1.03

- SPY VRO: 26.73 %

Stocks above MA (within S&P 500)

Advance Decline Line ADL (all NYSE, Detrended)

52 Week High Low (all NYSE)

Recommended use Table

| VMR | < 20% | 20% - 80% | > 80% | |

|---|---|---|---|---|

| Trend 4 Days | > +8% | Small Cap Opportunities | Strong Buy | Correction Incoming |

| > +4% | Strong Buy | Buy | Partial Take Profit | |

| > 0% | Buy | Buy | Hold | |

| < 0% | Wait for Correction | Hold | Hold | |

| < -4% | Wait for Correction | Sell | Stop Loss | |

| < -8% | Correction Incoming | Strong Sell | Sell Short Opportunities |

Recommend Options Strategies based on VMR

-

Bearish turn-around / Strong Sell: Long Puts

High expectation for IV to increase: Buy with low Premium and sell on higher Premium, while the stocks are going down. -

Sideways or Moderate uptrend / Hold or Buy: Short Iron Condor

Moderate expectation for IV to decrease: Ideally we want IV to decrease, while the stock price is in-between our short strikes.

Sell when 50% to 80% of the Premium is collected, or when the stock price is close to the short strikes. -

Moderate downtrend / Sell: do nothing

Sometimes its better to stay out of the market, just wait for a better opportunity. -

Bullish turn-around / Strong Buy: Bull Put Spread

Good expectation for IV to decrease: Collect Premiums now and buy them back when the Premium drops, while the stock is going up.

Before you buy, answer the following questions

- What is the current overall Market Regime?

- Does this stock has a sector-specific tail- or headwind?

- Is this stock the best in its Peer-Group?

- Why should other Investors buy and hold this stock?

- At what prices would Bagholders sell?

Other recommended sources to identify the Market Regime

- Is the AAII Investor Sentiment Survey above or below Historical Average?

- Is the VIX above or below 21, is the VIX Term Structure in Contango or Backwardation?

- Will the FED increase, hold or decrease the Interest Rate?

We developed a contrarian market regime indicator, based on seven different momentum indices, a sophisticated approach to assess market sentiment. Our contrarian indicator looks for divergences between market sentiments and price movements. Here's a deeper dive what we take into account:

Symbols used in this Market Regime Indicator

We use the following symbols to calculate the Market Regime Indicator, which is a weighted average of the individual indicators.

Note: The Nasdaq version of the indicators are not used in the calculation, but can be used as alternatives.

Note: The Nasdaq version of the indicators are not used in the calculation, but can be used as alternatives.

| Symbol | Description | Alternatives |

|---|---|---|

| S5TW | Percent of Stocks Above 20-Day Average S&P 500 | MMTW for Overall / NDTW for Nasdaq |

| S5FI | Percent of Stocks Above 50-Day Average S&P 500 | MMFI for Overall / NDFI for Nasdaq |

| S5TH | Percent of Stocks Above 200-Day Average S&P 500 | MMTH for Overall / NDTH for Nasdaq |

| MALN | 52 Weeks Lows New York Stock Exchang NYSE | MALQ for Nasdaq |

| MAHN | 52 Weeks High New York Stock Exchang NYSE | MAHQ for Nasdaq |

| ADVN (or NSHU) | Advancing Stocks NYSE | ADVQ for Nasdaq |

| DECN (or NSHD) | Declining Stocks NYSE | DECQ for Nasdaq |

SPY API Endpoint Limited to one call per minute