(FME) Fresenius Medical Care - Performance 16.9% in 12m

Compare FME with Indices, Sectors and Commodities and Bonds. Who performs better in which timeframe?

Performance Rating

-23.55%

#25 in Group

Rel. Strength

73.11%

#2161 in Universe

Total Return 12m

16.86%

#19 in Group

Total Return 5y

-32.01%

#32 in Group

P/E 22.7

59th Percentile in Group

P/E Forward 11.6

34th Percentile in Group

PEG 0.84

28th Percentile in Group

FCF Yield 10.8%

80th Percentile in Group

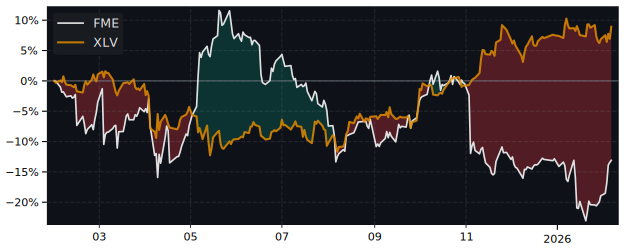

12m Total Return: FME (16.9%) vs XLV (0.3%)

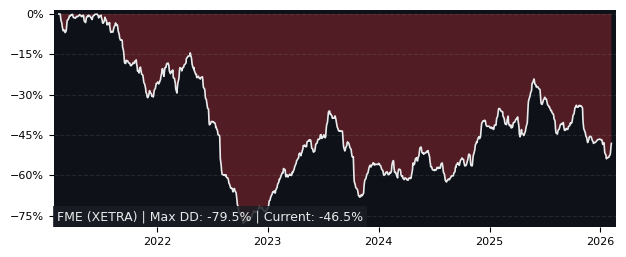

5y Drawdown (Underwater) Chart

Top Performers in Health Care Facilities

Overall best picks of Peer Group Selected by proven GARP Predictive Metrics, sorted by Growth Rating

| Symbol | 1m | 12m | 5y | P/E | P/E Forward | PEG | EPS Stability |

EPS CAGR |

|---|---|---|---|---|---|---|---|---|

| DR TO Medical Facilities |

-6.3% | 40.4% | 331% | 7.92 | 10.9 | 0.86 | 19.9% | 49.5% |

| ENSG NASDAQ The Ensign |

-3.01% | 7.66% | 228% | 25 | 20.5 | 1.37 | 77.9% | 12.1% |

| HCA NYSE HCA Holdings |

-2.54% | 5.23% | 208% | 15.5 | 13.4 | 1.11 | 23.5% | 7.99% |

| THC NYSE Tenet Healthcare |

-6.64% | 25.2% | 511% | 3.8 | 10 | 0.85 | 52.1% | 38.1% |

| ATT ST Attendo (publ) |

4.13% | 52.1% | 81.9% | 21.4 | - | 1.44 | 58.4% | 92.3% |

| SEM NYSE Select Medical Holdings |

1.64% | 19.7% | 120% | 32.1 | 15.3 | 1.37 | -24.2% | -21.2% |

| UHS NYSE Universal Health |

-7.65% | 4.41% | 67.2% | 9.59 | 8.76 | 1.87 | 48.8% | 19.2% |

| FRE XETRA Fresenius SE & Co. KGaA |

-0.28% | 46.6% | 15.3% | 24.7 | 11.2 | 0.27 | -78.3% | -16.5% |

Performance Comparison: FME vs XLV vs S&P 500

XLV (Health Care Sector SPDR ETF) is the Sector Benchmark for FME

| Total Return (including Dividends) | FME | XLV | S&P 500 |

|---|---|---|---|

| 1 Month | -5.51% | -4.97% | -4.31% |

| 3 Months | -8.31% | -6.08% | -7.85% |

| 12 Months | 16.86% | 0.26% | 10.76% |

| 5 Years | -32.01% | 47.01% | 106.31% |

| Trend Score (consistency of price movement) | FME | XLV | S&P 500 |

| 1 Month | -64.8% | -54.4% | -35.6% |

| 3 Months | -69.0% | -66.1% | -89.7% |

| 12 Months | 72.0% | -12% | 58.3% |

| 5 Years | -71.2% | 90% | 84.2% |

| Relative Strength (compared with Indexes) | Rank in Peer Group | vs. XLV | vs. S&P 500 |

| 1 Month | #29 | -0.56% | -1.25% |

| 3 Month | #27 | -2.38% | -0.50% |

| 12 Month | #19 | 16.6% | 5.51% |

| 5 Years | #32 | -53.8% | -67.1% |

FAQs

Does FME Fresenius Medical Care outperforms the market?

Yes,

over the last 12 months FME made 16.86%, while its related Sector, the Health Care Sector SPDR (XLV) made 0.26%.

Over the last 3 months FME made -8.31%, while XLV made -6.08%.

Over the last 3 months FME made -8.31%, while XLV made -6.08%.

Performance Comparison FME vs Indeces and Sectors

FME vs. Indices FME is Over or Underperforming

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| US S&P 500 | SPY | -5.20% | -1.20% | 14.2% | 6.10% |

| US NASDAQ 100 | QQQ | -7.16% | -1.27% | 14.2% | 4.85% |

| US Dow Jones Industrial 30 | DIA | -3.13% | 0.27% | 14.0% | 9.88% |

| German DAX 40 | DAX | -2.54% | -1.70% | -4.19% | -6.65% |

| Shanghai Shenzhen CSI 300 | CSI 300 | 1.33% | -2.01% | 15.7% | 8.24% |

| Hongkong Hang Seng | HSI | -2.93% | -2.63% | 12.4% | 2.84% |

| India NIFTY 50 | INDA | 2.23% | -7.07% | 12.6% | 15.1% |

| Brasil Bovespa | EWZ | -4.95% | -7.48% | 9.74% | 22.4% |

FME vs. Sectors FME is Over or Underperforming

| Symbol | 1w | 1m | 6m | 12m | |

|---|---|---|---|---|---|

| Communication Services | XLC | -5.06% | 0.07% | 5.50% | -5.54% |

| Consumer Discretionary | XLY | -7.55% | -1.47% | 11.1% | 2.51% |

| Consumer Staples | XLP | 2.26% | -8.26% | 8.92% | 7.37% |

| Energy | XLE | -1.85% | 6.12% | 16.7% | 28.8% |

| Financial | XLF | -3.24% | -0.73% | 6.14% | -2.44% |

| Health Care | XLV | -2.18% | -0.54% | 16.3% | 16.6% |

| Industrial | XLI | -3.37% | -1.44% | 13.9% | 9.95% |

| Materials | XLB | -1.95% | -1.0% | 21.1% | 22.2% |

| Real Estate | XLRE | -0.37% | -3.60% | 16.4% | 1.74% |

| Technology | XLK | -9.01% | -0.99% | 19.1% | 10.6% |

| Utilities | XLU | -1.05% | -7.19% | 11.1% | -3.58% |

| Aerospace & Defense | XAR | -4.76% | -5.21% | 2.97% | -10.1% |

| Biotech | XBI | -4.33% | 2.33% | 27.3% | 19.1% |

| Homebuilder | XHB | -3.45% | 0.51% | 29.2% | 24.8% |

| Retail | XRT | -2.41% | -2.58% | 18.4% | 20.5% |